Monroe County Ny Tax Rate . Monroe county, ny sales tax rate. Click for sales tax rates, monroe county sales tax calculator, and printable sales tax table. Look up 2024 sales tax rates for monroe county, new york. Tax rates provided by avalara are updated regularly. The current sales tax rate in monroe county, ny is 8%. New york has a 4% sales tax and monroe county collects an additional 4%, so the minimum sales tax rate in monroe county is 8% (not including. The table below outlines county, city and town tax rates by specific municipality. New york state sales and use tax rates by jurisdiction effective march 1, 2022 the following list includes the state tax rate. 33 rows 2024 town & county tax rates. The current total local sales tax rate in monroe county, ny is 8.000%.

from mungfali.com

The current total local sales tax rate in monroe county, ny is 8.000%. Monroe county, ny sales tax rate. Tax rates provided by avalara are updated regularly. The table below outlines county, city and town tax rates by specific municipality. Look up 2024 sales tax rates for monroe county, new york. New york has a 4% sales tax and monroe county collects an additional 4%, so the minimum sales tax rate in monroe county is 8% (not including. Click for sales tax rates, monroe county sales tax calculator, and printable sales tax table. 33 rows 2024 town & county tax rates. The current sales tax rate in monroe county, ny is 8%. New york state sales and use tax rates by jurisdiction effective march 1, 2022 the following list includes the state tax rate.

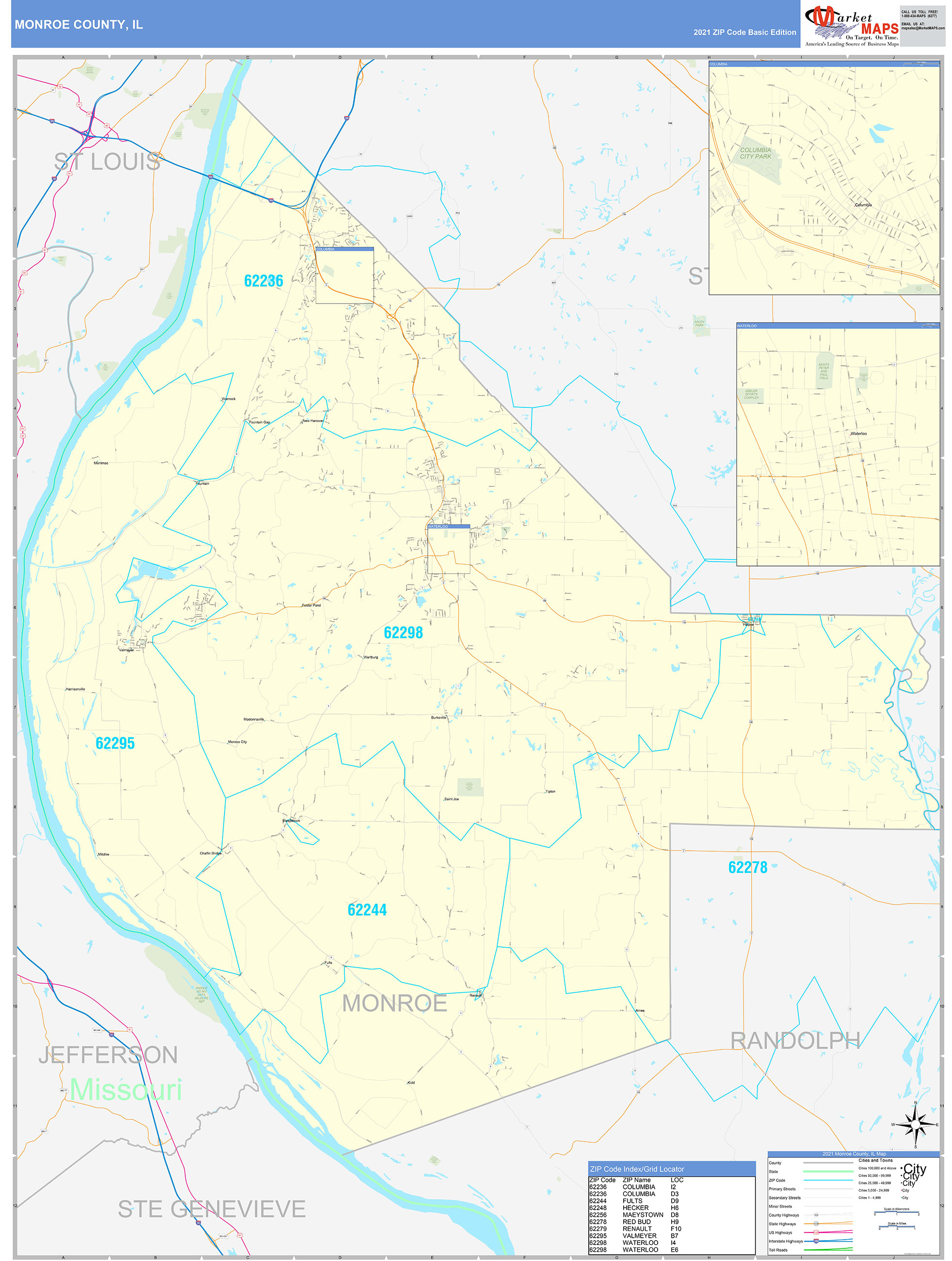

Monroe County Zip Code Map

Monroe County Ny Tax Rate The current sales tax rate in monroe county, ny is 8%. New york state sales and use tax rates by jurisdiction effective march 1, 2022 the following list includes the state tax rate. Tax rates provided by avalara are updated regularly. Monroe county, ny sales tax rate. The current sales tax rate in monroe county, ny is 8%. Click for sales tax rates, monroe county sales tax calculator, and printable sales tax table. The table below outlines county, city and town tax rates by specific municipality. Look up 2024 sales tax rates for monroe county, new york. New york has a 4% sales tax and monroe county collects an additional 4%, so the minimum sales tax rate in monroe county is 8% (not including. 33 rows 2024 town & county tax rates. The current total local sales tax rate in monroe county, ny is 8.000%.

From beabannadiane.pages.dev

Iowa State Tax Rates For 2024 Britt Colleen Monroe County Ny Tax Rate New york state sales and use tax rates by jurisdiction effective march 1, 2022 the following list includes the state tax rate. Click for sales tax rates, monroe county sales tax calculator, and printable sales tax table. The table below outlines county, city and town tax rates by specific municipality. Monroe county, ny sales tax rate. The current sales tax. Monroe County Ny Tax Rate.

From darlenewlonee.pages.dev

Monroe County Tax Foreclosure Auction 2024 Cilka Shannon Monroe County Ny Tax Rate The current sales tax rate in monroe county, ny is 8%. 33 rows 2024 town & county tax rates. Look up 2024 sales tax rates for monroe county, new york. The table below outlines county, city and town tax rates by specific municipality. New york has a 4% sales tax and monroe county collects an additional 4%, so the minimum. Monroe County Ny Tax Rate.

From luciagardnervercher.blogspot.com

Map Of Monroe County Ny Wisconsin State Parks Map Monroe County Ny Tax Rate The current total local sales tax rate in monroe county, ny is 8.000%. 33 rows 2024 town & county tax rates. Monroe county, ny sales tax rate. Click for sales tax rates, monroe county sales tax calculator, and printable sales tax table. New york has a 4% sales tax and monroe county collects an additional 4%, so the minimum sales. Monroe County Ny Tax Rate.

From westerneuropemap.blogspot.com

Monroe County Ny Tax Maps Western Europe Map Monroe County Ny Tax Rate The table below outlines county, city and town tax rates by specific municipality. New york state sales and use tax rates by jurisdiction effective march 1, 2022 the following list includes the state tax rate. New york has a 4% sales tax and monroe county collects an additional 4%, so the minimum sales tax rate in monroe county is 8%. Monroe County Ny Tax Rate.

From almirabcosetta.pages.dev

Texas State Sales Tax 2024 Lonni Randene Monroe County Ny Tax Rate The current sales tax rate in monroe county, ny is 8%. Look up 2024 sales tax rates for monroe county, new york. The current total local sales tax rate in monroe county, ny is 8.000%. Monroe county, ny sales tax rate. The table below outlines county, city and town tax rates by specific municipality. New york has a 4% sales. Monroe County Ny Tax Rate.

From www.taxmypropertyfairly.com

Upstate NY Has Some of the Highest Property Tax Rates in the Nation Monroe County Ny Tax Rate New york state sales and use tax rates by jurisdiction effective march 1, 2022 the following list includes the state tax rate. The table below outlines county, city and town tax rates by specific municipality. Tax rates provided by avalara are updated regularly. New york has a 4% sales tax and monroe county collects an additional 4%, so the minimum. Monroe County Ny Tax Rate.

From www.usnews.com

How Healthy Is Monroe County, Pennsylvania? US News Healthiest Monroe County Ny Tax Rate Monroe county, ny sales tax rate. Look up 2024 sales tax rates for monroe county, new york. Tax rates provided by avalara are updated regularly. Click for sales tax rates, monroe county sales tax calculator, and printable sales tax table. New york state sales and use tax rates by jurisdiction effective march 1, 2022 the following list includes the state. Monroe County Ny Tax Rate.

From mungfali.com

Otsego County Map Monroe County Ny Tax Rate Monroe county, ny sales tax rate. The current total local sales tax rate in monroe county, ny is 8.000%. New york has a 4% sales tax and monroe county collects an additional 4%, so the minimum sales tax rate in monroe county is 8% (not including. The table below outlines county, city and town tax rates by specific municipality. New. Monroe County Ny Tax Rate.

From www.fill.io

Fill Free fillable forms Monroe County Monroe County Ny Tax Rate Look up 2024 sales tax rates for monroe county, new york. Tax rates provided by avalara are updated regularly. Monroe county, ny sales tax rate. The table below outlines county, city and town tax rates by specific municipality. The current total local sales tax rate in monroe county, ny is 8.000%. Click for sales tax rates, monroe county sales tax. Monroe County Ny Tax Rate.

From www.vrogue.co

Monroe County Map Map Of Monroe County Ny vrogue.co Monroe County Ny Tax Rate 33 rows 2024 town & county tax rates. The current total local sales tax rate in monroe county, ny is 8.000%. New york state sales and use tax rates by jurisdiction effective march 1, 2022 the following list includes the state tax rate. Monroe county, ny sales tax rate. The current sales tax rate in monroe county, ny is 8%.. Monroe County Ny Tax Rate.

From almirabcosetta.pages.dev

Wv State Tax Rates 2024 Lonni Randene Monroe County Ny Tax Rate The current sales tax rate in monroe county, ny is 8%. The table below outlines county, city and town tax rates by specific municipality. New york has a 4% sales tax and monroe county collects an additional 4%, so the minimum sales tax rate in monroe county is 8% (not including. New york state sales and use tax rates by. Monroe County Ny Tax Rate.

From madisontitle.com

NY Sales Tax Chart Monroe County Ny Tax Rate The current sales tax rate in monroe county, ny is 8%. Tax rates provided by avalara are updated regularly. Click for sales tax rates, monroe county sales tax calculator, and printable sales tax table. Look up 2024 sales tax rates for monroe county, new york. Monroe county, ny sales tax rate. The table below outlines county, city and town tax. Monroe County Ny Tax Rate.

From www.uslandgrid.com

Monroe County Tax Parcels / Ownership Monroe County Ny Tax Rate The current sales tax rate in monroe county, ny is 8%. The table below outlines county, city and town tax rates by specific municipality. Look up 2024 sales tax rates for monroe county, new york. Monroe county, ny sales tax rate. Tax rates provided by avalara are updated regularly. The current total local sales tax rate in monroe county, ny. Monroe County Ny Tax Rate.

From celestiawjoey.pages.dev

Nyc Tax Rates 2024 Lexi Shayne Monroe County Ny Tax Rate 33 rows 2024 town & county tax rates. New york state sales and use tax rates by jurisdiction effective march 1, 2022 the following list includes the state tax rate. The table below outlines county, city and town tax rates by specific municipality. Look up 2024 sales tax rates for monroe county, new york. Tax rates provided by avalara are. Monroe County Ny Tax Rate.

From shop.old-maps.com

Monroe County New York 1840 Burr State Atlas OLD MAPS Monroe County Ny Tax Rate The table below outlines county, city and town tax rates by specific municipality. The current total local sales tax rate in monroe county, ny is 8.000%. The current sales tax rate in monroe county, ny is 8%. 33 rows 2024 town & county tax rates. New york state sales and use tax rates by jurisdiction effective march 1, 2022 the. Monroe County Ny Tax Rate.

From londontopattractionsmap.github.io

Washington County Ny Tax Map London Top Attractions Map Monroe County Ny Tax Rate Click for sales tax rates, monroe county sales tax calculator, and printable sales tax table. Monroe county, ny sales tax rate. New york has a 4% sales tax and monroe county collects an additional 4%, so the minimum sales tax rate in monroe county is 8% (not including. Tax rates provided by avalara are updated regularly. 33 rows 2024 town. Monroe County Ny Tax Rate.

From andyarthur.org

Thematic Map 2021 Combined Municipal and County Taxes Per 1,000 Monroe County Ny Tax Rate Tax rates provided by avalara are updated regularly. Monroe county, ny sales tax rate. The table below outlines county, city and town tax rates by specific municipality. New york has a 4% sales tax and monroe county collects an additional 4%, so the minimum sales tax rate in monroe county is 8% (not including. The current sales tax rate in. Monroe County Ny Tax Rate.

From taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates Monroe County Ny Tax Rate The table below outlines county, city and town tax rates by specific municipality. Click for sales tax rates, monroe county sales tax calculator, and printable sales tax table. New york state sales and use tax rates by jurisdiction effective march 1, 2022 the following list includes the state tax rate. 33 rows 2024 town & county tax rates. The current. Monroe County Ny Tax Rate.